LINDUNGI

DATAMU!

Waspada Terhadap Berbagai Modus Penipuan yang Mengatasnamakan KrediOne!

Waspada Terhadap Berbagai Modus Penipuan yang Mengatasnamakan KrediOne!

Akibat maraknya modus penipuan yang mengatasnamakan KrediOne, pengguna KrediOne diharapkan untuk selalu berhati-hati dalam menerima atau memberikan informasi.

Berikut contoh modus penipuan yang sering terjadi:

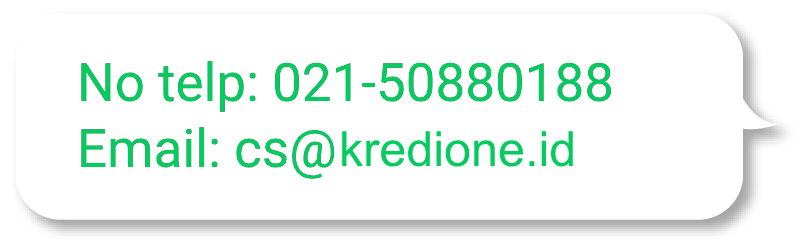

Kontak resmi Customer Service KrediOne hanya melalui Email: cs@kredione.id dan Hotline: 021-50880188 serta seluruh akun media sosial KrediOne, selain itu dapat dipastikan PALSU atau PENIPUAN. Kamu bisa cek daftar kontak dan akun sosial media resmi KrediOne dengan klik "Hubungi Kami".

Lindungi Data Pribadi

Informasi pribadi seperti nomor identitas, alamat, dan detail rekening bank sangat berharga bagi penipu. Jangan pernah membagikan informasi ini, terutama melalui telepon atau pesan yang tidak aman. Pastikan juga untuk tidak membagikan informasi di media sosial yang dapat dimanfaatkan oleh pihak yang tidak bertanggung jawab.

Verifikasi Sebelum Bertransaksi

Selalu pastikan bahwa informasi yang kamu terima adalah benar. Jika kamu menerima tawaran yang mencurigakan, lakukan pengecekan lebih lanjut dengan mengunjungi situs web resmi KrediOne atau hubungi Customer Service untuk memastikan kebenaran tawaran tersebut. Penipu sering kali menggunakan teknik manipulasi untuk membuat kamu cepat dalam mengambil keputusan tanpa melakukan verifikasi terlebih dulu.

Jangan Berikan Kode OTP

Kode OTP (One-Time Password) adalah langkah keamanan awal untuk melindungi akun kamu ketika bertransaksi secara digital dan KrediOne tidak akan pernah meminta kode OTP melalui telepon atau pesan. Jika kamu merasa diminta untuk memberikan kode OTP oleh oknum yang mengatasnamakan diri sebagai KrediOne, segera hubungi Customer Service KrediOne untuk memastikan kebenaranya dan laporkan kejadian tersebut agar bisa ditindaklanjuti secara mendalam.

Lindungi Diri Kamu dari Penipuan dengan Melakukan Konfirmasi Melalui Kontak Resmi KrediOne

Jika kamu menemukan informasi mencurigakan yang mengatasnamakan KrediOne, segera konfirmasi dan laporkan kepada Customer Service resmi KrediOne melalui:

Jadi, tetap hati-hati dan waspada terhadap segala jenis modus penipuan yang mengatasnamakan KrediOne ya!

Unduh Aplikasi KrediOne

Layanan kami

Layanan Pengaduan Konsumen

021-50880188

Senin-Minggu

8.00-20.00WIB

Kantor Pusat

Sampoerna Strategic Square North Tower Lt 27,Jl. Jenderal Sudirman No.45 - 46, RT.3/RW.4,

Karet Semanggi, Kecamatan Setiabudi, Jakarta Selatan

DKI Jakarta 12930

Kantor Pelayanan Pelanggan

Komplek Arteri Mas No 64 dan 64B,Jl. Panjang Arteri Kelapa Dua Raya No.2, RT.2/RW.2,

Kelapa Dua, Kecamatan Kebon Jeruk, Jakarta Barat

DKI Jakarta 11550

Disclaimer Risiko

- Layanan Pendanaan Bersama Berbasis Teknologi Informasi merupakan kesepakatan perdata antara Pemberi Pinjaman dengan Penerima Pinjaman, Sehingga segala risiko yang timbul dari kesepakatan tersebut ditanggung sepenuhnya oleh masing-masing pihak.

- Risiko kredit atau gagal bayar ditanggung sepenuhnya oleh Pemberi Pinjaman. Tidak ada lembaga atau otoritas negara yang bertanggung jawab atas risiko gagal bayar ini.

- Penyelenggara dengan persetujuan dari masing-masing Pengguna (Pemberi Pinjaman dan/atau Penerima Pinjaman) mengakses, memperoleh, menyimpan, mengelola dan/atau menggunakan data pribadi Pengguna ("Pemanfaatan Data") pada atau di dalam benda, perangkat elektronik (termasuk smartphone atau telepon seluler), perangkat keras (hardware) maupun lunak (software), dokumen elektronik, aplikasi atau sistem elektronik milik Pengguna atau yang dikuasai Pengguna, dengan memberitahukan tujuan, batasan dan mekanisme Pemanfaatan Data tersebut kepada Pengguna yang bersangkutan sebelum memperoleh persetujuan yang dimaksud.

- Pemberi Pinjaman yang belum memiliki pengetahuan dan pengalaman pinjam meminjam, disarankan untuk tidak menggunakan layanan ini.

- Penerima Pinjaman harus mempertimbangkan tingkat bunga pinjaman dan biaya lainnya sesuai dengan kemampuan dalam melunasi pinjaman.

- Setiap kecurangan tercatat secara digital di dunia maya dan dapat diketahui masyarakat luas di media sosial

- Pengguna harus membaca dan memahami informasi ini sebelum membuat keputusan menjadi Pemberi Pinjaman atau Penerima Pinjaman.

- Pemerintah yaitu dalam hal ini Otoritas Jasa Keuangan, tidak bertanggung jawab atas setiap pelanggaran atau ketidakpatuhan oleh Pengguna, baik Pemberi Pinjaman maupun Penerima Pinjaman (baik karena kesengajaan atau kelalaian Pengguna) terhadap ketentuan peraturan perundang-undangan maupun kesepakatan atau perikatan antara Penyelenggara dengan Pemberi Pinjaman dan/atau Penerima Pinjaman.

- Setiap transaksi dan kegiatan pinjam meminjam atau pelaksanaan kesepakatan mengenai pinjam meminjam antara atau yang melibatkan Penyelenggara, Pemberi Pinjaman dan/atau Penerima Pinjaman wajib dilakukan melalui escrow account dan virtual account sebagaimana yang diwajibkan berdasarkan Peraturan Otoritas Jasa Keuangan Republik Indonesia Nomor POJK 40/2024 tentang Layanan Pendanaan Bersama Berbasis Teknologi Informasi dan pelanggaran atau ketidakpatuhan terhadap ketentuan tersebut merupakan bukti telah terjadinya pelanggaran hukum oleh Penyelenggara sehingga Penyelenggara wajib menanggung ganti rugi yang diderita oleh masing-masing Pengguna sebagai akibat langsung dari pelanggaran hukum tersebut di atas tanpa mengurangi hak Pengguna yang menderita kerugian menurut Kitab Undang-Undang Hukum Perdata.

Copyright © 2025 PT Inovasi Terdepan Nusantara.

All right reserved

HATI-HATI, TRANSAKSI INI BERISIKO TINGGI. ANDA DAPAT SAJA MENGALAMI KERUGIAN ATAU KEHILANGAN UANG. JANGAN BERUTANG JIKA TIDAK MEMILIKI KEMAMPUAN MEMBAYAR. PERTIMBANGKAN SECARA BIJAK SEBELUM BERTRANSAKSI.